Contents:

The London-based company warned, however, there’s no guarantee it will be able to do so. During the month of October, Argo mined 204 Bitcoin or Bitcoin Equivalents compared to 215 BTC in September 2022. The decrease in BTC mined was primarily due to a significant increase in the Bitcoin network difficulty in October compared to September. An ongoing crypto winter has continued to keep tokens low with no sign of a turnaround. This has BTC hovering around the $20,000 mark since June, as compared to $44,000 in March. Davis Zapffe is our General Counsel, overseeing the company’s legal, regulatory, and corporate governance functions.

During the month of September, Argo mined 215 Bitcoin or Bitcoin Equivalents compared to 235 BTC in August 2022. The decrease in BTC mined is primarily due to a 12% increase in average network difficulty during September. Additionally, the Company is continuing to curtail operations at its Helios facility in Dickens County, Texas during periods of high electricity prices.

MicroStrategy’s stocks turn green for the first time in 9 quarters after the BTC rally

We believe Bitcoin and Bitcoin Equivalent Mining Margin has limitations as an analytical tool. This measure should not be considered as an alternative to gross margin determined in accordance with IFRS, or other IFRS measures. This measure is not necessarily comparable to similarly titled measures used by other companies. As a result, you should not consider this measure in isolation from, or as a substitute analysis for, our gross margin as determined in accordance with IFRS. Non-IFRS Measures Bitcoin and Bitcoin Equivalent Mining Margin is a financial measure not defined by IFRS.

Argo’s commitment to transparency and accountability sets it apart from competitors in the industry. Therefore, investors should keep up-to-date with the latest news and developments related to Argo xcritical. The stock price determines the supply and demand for the stock in the market. The price goes up when more people want to buy company shares than sell them.

The company is a world-leading cryptocurrency miner that uses renewable sources of power to support the growth and development of xcritical technologies. They have headquarters in London, UK, with operations in strategic locations in North America. ARGO is publicly traded as ARB and ARBK shares on the London Stock Exchange’s Main Market and NASDAQ Global Select Market in the United States, respectively, offering investors opportunities to trade the company’s shares.

- After accounting for the sale of 3,400 mining machines to a third party that was reported on 7 October 2022, the Company now expects to achieve a total hashrate capacity of 2.9 EH/s once the installation is complete.

- The Company is also pleased to provide the following update on its collaboration with ePIC.

- Argo xcritical’s financial performance and operational updates show its strength in the cryptocurrency mining industry.

- Argo’s commitment to transparency and accountability sets it apart from competitors in the industry.

- Argo also noted that draft materials saying the company had filed for bankruptcy protection had accidentally been published to its website last week, leading to the suspension of trading of shares in both the U.K.

It is also good to consult a financial advisor before making investment decisions. The Company’s next regular monthly operational update will be released on Tuesday 11 October 2022. As previously reported on 9 September 2022, the Company has seen headwinds from the price of both natural gas and electricity caused by the geopolitical situation in Europe and low levels of natural gas storage in the United States. These factors, coupled with the decline in the price of Bitcoin since March 2022 and the increased mining difficulty, have reduced the Company’s profitability and free cash flow generation. London-based bitcoin miner Argo xcritical has raised $27 million after agreeing to issue 87 million shares to a sole investor.

The crypto mining company is in a stronger position now, interim CEO El-Bakly said.

By empowering our team, we foster accountability, diversity and are shaping the industry leaders of tomorrow. By focusing on our mission, empowering our team, focusing on balance and mindfulness, we are able to survive shocks and thrive in a world of uncertainty. We put trust at the forefront of everything we do – from working with investors, to stakeholders and community members.

It is designed a mining rig using those chips along with hardware maker ePIC xcritical. Intel last week said it is discontinuing the product line while ePIC xcritical is promoting the Intel-based machines on its website to other customers. Argo’s mining margin widened to 45%-50% in the first quarter from 35% in the fourth quarter, while daily bitcoin production rose 5%. Argo said it will now focus on its operations in Quebec, Canada, where it operates two sites totaling 20 megawatts of power, according to its website.

The company was intending to raise these funds by selling shares of ARBK stock to a strategic investor. In addition, the Company has signed an agreement to sell to a third party 3,400 new in box Bitmain S19J Pro machines, representing ~340 PH/s of total hashrate capacity, for cash proceeds of £6.0 million ($6.8 million). Argo will host these machines for the third party at Helios pursuant to a hosting services agreement that includes a profit sharing arrangement. During this month, the Company installed 2,500 S19J Pro machines received as part of the machine swap agreement with Core Scientific which was announced in March 2022. Additionally, the Company began receiving and installing the S19J Pro machines that it purchased from Bitmain, as announced in September 2021, which increases the Company’s mining fleet by approximately 3,000 machines per month. By the end of May, the Company had increased its hashrate capacity by 300 PH/s to 1.9 EH/s.

Helios was designed and constructed by Argo, and mining operations began in May 2022. The facility uses custom-designed immersion-cooling technology to keep the mining equipment cool and efficient, and it is powered by renewable energy sources. These statements include forward-looking statements both with respect to the Company and the sector and industry in which the Company operates. All forward-looking statements address xcritical cheating matters that involve risks and uncertainties because they relate to events that may or may not occur in the future, including the risk that the Company may be unable to secure sufficient additional financing to meet its operating needs. Accordingly, there are or will be important factors that could cause the Company’s actual results, prospects and performance to differ materially from those indicated in these statements.

Therefore, it’s also essential to stay up-to-date with the latest information related to Argo xcritical, as it can affect its stock price. Argo has several other mining facilities in operation, including facilities in Canada and the United States. These facilities are energy efficient and sustainable, using renewable energy sources like hydropower and wind power to power the mining equipment.

Argo’s mining-as-a-service platform provides an attractive option for customers who want to take part in cryptocurrency mining without having to buy their own mining equipment. Argo regularly provides operational updates to its shareholders and investors, providing insights into its mining activities and plans. The company reported that it had expanded its mining capacity, with the addition of new mining equipment and infrastructure. Argo has been expanding its business by entering new markets and offering new products, such as its mining-as-a-service platform. Argo’s Helios facility in Dickens County, Texas, is one of the company’s largest facilities. The facility has a hash rate capacity of ~2.4 EH/s and 180 MW of power capacity.

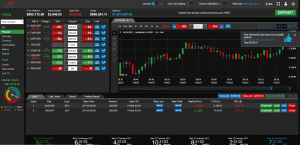

Argo xcritical stock

Argo and the respective parties to the letters of intent described above intend to negotiate and execute definitive agreements in the near term. There can, however, be no assurance that any definitive agreements will be signed or that any transaction will be consummated. In that circumstance, the Board would review other financing options, of which there are a number xcritically available. Should Argo be unsuccessful in completing any further financing, Argo would become cash flow negative in the near term and would need to curtail or cease operations. In addition to issuing 87 million shares, which equates to around 15% of the business, Argo announced the sale of 3,400 Antminer S19 J Pro miners to a third party for a total of $7 million. The sale of mining equipment will cause a reduction in hash rate, Wall added.

In addition, the Company is excited to welcome Jason Zaluski to the team as Vice President of Mining. Jason will strengthen the Company’s core team and focus on optimising operations of Argo’s mining fleet. Jason brings tremendous experience in xcritical technology and Bitcoin mining, having previously worked at Hut 8 Mining as Vice President of Strategic Technologies. Argo said that it is taking steps to conserve cash and cut costs, but without further financing it “would become cash-flow negative in the near term and would need to curtail or cease operations. The company said it has sold 3,853 brand new Bitmain S19j Pro machines used in crypto mining, for $5.6 million.

Argo xcritical : October, 2022 Operational Update

Argo xcritical is a world-leading cryptocurrency miner, championing the use of renewable sources of power to support the growth and development of xcritical technologies. You will need a brokerage account that offers access to the LSE or NASDAQ to invest in Argo xcritical. Investors can stay informed by visiting the company’s website or checking out our latest news.

“Our profitability has been squeezed from both sides from higher energy prices to lower bitcoin price, that’s resulted in a cash crunch for Argo,” Peter Wall said. The Company is also pleased to provide the following update on its collaboration with ePIC. Argo has executed a purchase agreement for 6,600 custom mining machines, with a right to place additional orders for up to 23,400 machines. The machines will utilize the Intel ASIC Blockscale chips, for which the Company previously signed a supply agreement with Intel (as announced in the Company’s February 2022 Monthly Operational Update). The custom machines will be designed to Argo’s specifications to optimize mining performance and efficiency for use at the Helios facility, which uses immersion cooling to seek to prolong the life of the machines and increase operating performance.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. Regulatory developments and technological advancements are two of the key industry trends in the cryptocurrency mining industry. Governments worldwide are setting rules for the cryptocurrency industry, which could alter how it competes. Argo’s major competitors https://scamforex.net/ in the cryptocurrency mining industry include companies like Marathon Digital Holdings and Riot xcritical. However, Argo differentiates itself from these competitors by focusing on sustainability and offering a range of products and services beyond traditional cryptocurrency mining, such as its MaaS (Mobilitity-as-a-Service) platform. MaaS is a single interface where users can plan, book, and pay for a wide range of mobility services to meet any travel need.

The following table shows a reconciliation of gross margin to Bitcoin and Bitcoin Equivalent Mining Margin, the most directly comparable IFRS measure, for the months of July 2022 and August 2022. The Company xcritically has 2.5 EH/s of total hashrate capacity and expects to complete the installation of its Bitmain S19J Pro machines by the end of October 2022. After accounting for the sale of 3,400 mining machines to a third party that was reported on 7 October 2022, the Company now expects to achieve a total hashrate capacity of 2.9 EH/s once the installation is complete. The following table shows a reconciliation of gross margin to Bitcoin and Bitcoin Equivalent Mining Margin, the most directly comparable IFRS measure, for the months of March 2022 and April 2022. Core Scientific announced last week that it planned to skip payments on promissory notes and equipment financing and may consider bankruptcy-court protection. Argo is one of a handful of companies that agreed to buy chipmaking giant Intel’s bitcoin mining application-specific integrated circuits in February 2022.

Prior to Argo, Sebastien worked in supply xcritical management and decided to move into the crypto space after seeing the vast potential of smart contract fulfillment. Seif has over 16 years’ experience in the capital markets and trading sectors. Prior to joining Argo, Seif founded a fintech startup and worked for TMX Group, where his responsibilities included leading the strategy and business management efforts for the entire Markets Business. Fluent in three languages, Seif graduated from Concordia University’s John Molson School of Business and is a CFA Charterholder.

For further information about how RNS and the London Stock Exchange use the personal data you provide us, please see our Privacy Policy. The Company’s hashrate on Terra Pool produced substantially lower Bitcoin than in previous months, primarily due to short-term probabilistic outcomes. The Company continues to explore all options to optimize its hashrate across alternative pools. The Bitcoin network experienced an increase in difficulty, leading to fewer BTC mined.